Here comes the tax grab: what are your chances of being hit?

Sir Keir Starmer has given the clearest indication yet that tax rises will be part of next month’s budget and suggested that “those with the broadest shoulders” will be the most affected.

At Downing Street on Tuesday, the prime minister said: “I will be honest with you. There is a budget coming in October and it’s going to be painful.

We look at where the pain is likely to come, and what you can you do about it.

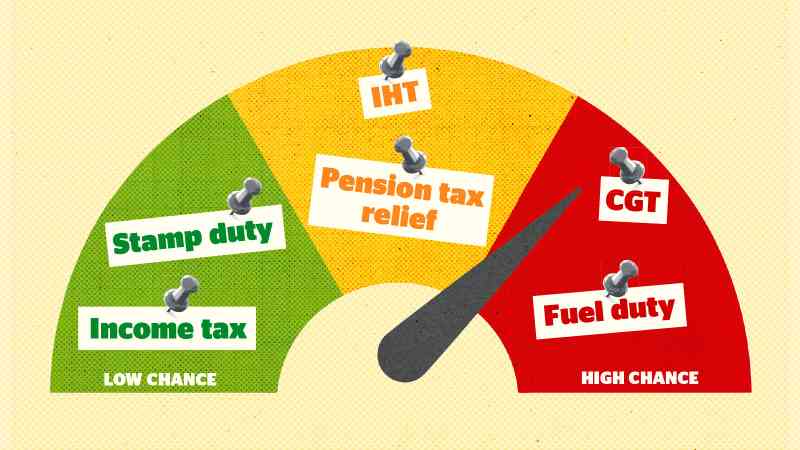

Capital gains tax (CGT) applies on profits made when you sell assets such as shares and property. It is charged at between 10 and 28 per cent, depending on your income tax rate and the type of asset. You have an annual allowance of £3,000, which is the gain you can make each year tax-free. The government could increase the rates or align them to the income tax rates of 20, 40 and 45 per cent.

What are the chances of a rise?Very high. Those with the “broadest shoulders” are the most likely to own assets that are subject to CGT and this could be an easy target for the Labour government.

What you can do If you hold listed shares that have made a capital gain, you may want to sell them before the budget. This way you could take advantage of any unused CGT allowance and then buy the shares again afterwards.

• Should capital gains tax be raised to 40 per cent?

Inheritance tax (IHT) of up to 40 per cent applies to assets that you pass on when you die, including cash, shares and property worth more than £325,000. This allowance increases to £500,000 if your estate includes a main home that you are passing on to a direct descendant, such as a child or grandchild.

IHT raises £7.7 billion a year, which is less than 1 per cent of total tax receipts, and only 4 per cent of estates pay it.

The government has not pledged to leave IHT alone, so it could look to lower the allowances. It may also tinker with the “seven-year rule”, which applies to all assets you give away while you are alive. If you live for seven years after making the gift its value falls out of your estate for IHT purposes.

What are the chances of a rise in IHT?Medium. Nimesh Shah from the accountancy firm Blick Rothenberg said: “The government will see an opportunity to get more estates paying more IHT, given how little it generates at the moment.”

What you can doIf you are thinking about making a gift to a child or grandchild, do it before October 30.

• Do you pay tax on your pension?

Pension contributions benefit from tax relief at your income tax rate. This means that the government pays back any income tax you have paid on the contribution, with the idea that this encourages saving for retirement. However, this rebate costs the government £45 billion a year. Giving everyone a flat rate of 20 per cent could save billions of pounds.

What are the chances of a change?Medium. While limiting pension tax relief could raise revenue, the government also wants to encourage pension funds to invest more in UK infrastructure. Reducing the incentive for saving into a pension could mean less money for investing.

What you can doIf you are a higher rate taxpayer and planning to pay extra into your pension in this tax year, you should do it before October 30. Also use up any unused allowances from the previous three tax years — you can save up to £60,000 a year.

• Stop speculating about stamp duty

Stamp duty land tax is the tax you pay when you buy a property that is worth more than £250,000, or £425,000 if you are a first-time buyer. The rates range between 5 and 12 per cent. A 3 percentage point surcharge applies if you are purchasing a second home or additional property.

What are the chances of an increase?Low. Stamp duty rates have never been so high and any further increase could harm the housing market.

What you can doThe best answer here might be to do nothing. Shah said: “We could all be taken by surprise if the government decides that it needs to give more support to first-time buyers, although a fairly generous regime already exists for them.”

This is paid on the income you make from shares or from a business you own, above a £500 annual allowance. Dividend income is taxed at 8.75 per cent for basic-rate taxpayers, 33.75 per cent for higher-rate taxpayers and 39.35 per cent for additional-rate taxpayers. To simplify the system, the rates could be aligned to the income tax rates and the £500 allowance could be abolished.

What are the chances of a rise?Medium. A higher dividend tax would be a relatively easy win for the government and could be presented as a simplification to the tax system. However, it may go against the government’s pro-business growth agenda.

What you can doMaximise your Isa contributions across your family so that you spread out your dividend income. The Isa limit is £20,000 for adults and £9,000 for children under 18.

Income tax is paid on income from employment, cash, bonds and rent if you are a landlord.

What are the chances of a rise?Low, but not zero. Although the government ruled out a rise, it was only for “ordinary working people”. Laura Suter from the wealth manager AJ Bell said: “This does leave a bit of wriggle room to increase income tax rates on other types of income, such as savings income or rental profits.

“It could also be argued that those earning more than £125,140 and who pay the 45 per cent rate of tax are not ordinary working people. The warning given by the prime minister that those with the broadest shoulders will bear the biggest burden could mean that an increase in the top rate of tax is possible without the chancellor breaking her promise.”

What you can doMaximise contributions to your pension and Isa and transfer income-producing assets to a lower-earning spouse.

Fuel duty has been frozen since 2011 and a temporary 5p cut has been in place since 2022.

What are the chances of a rise? High. Reversing the 5p cut would be straightforward for the government to do, and it would provide an instant cash injection to the Treasury because it costs the government £2 billion a year. The RAC said the fuel duty freeze does not benefit motorists anyway and simply boosts the profits of the fuel sellers. Fuel costs have also come down since 2022 adding further justification for a tax rise.

What you can do Make sure to fill up your tank before October 30. If you are in the process of buying a new car, think about switching to electric.

Post Comment